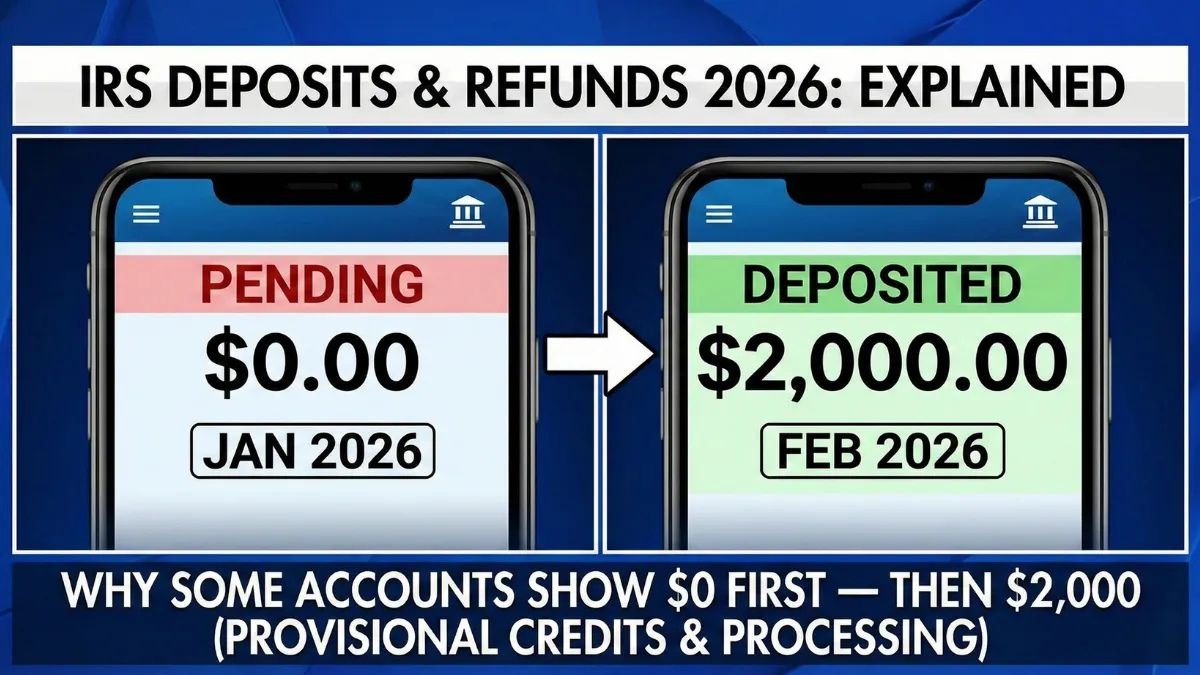

Have you checked your bank account in early 2026 and spotted a strange $0 IRS deposit that suddenly turns into $2,000? This common occurrence leaves many taxpayers puzzled and worried, often mistaking it for a rejected refund or glitch. In truth, it’s a normal part of how banks handle IRS direct deposits, designed to verify transactions securely before finalizing your tax refund 2026.

By understanding this process—from the IRS sending funds to your bank crediting them—you can avoid unnecessary stress. This guide breaks down the mechanics, timelines, and actions to take, ensuring you track your refund confidently without filing hasty amendments or making frantic calls.

Decoding the $0 Placeholder in IRS Deposits

The $0 entry, often labeled as “TREAS 310” or similar, acts as a temporary flag from your bank. When the IRS initiates a transfer through the Automated Clearing House (ACH) network, banks receive early notification but delay posting the full amount until they confirm details.

This step is like a pre-authorization hold on a debit card purchase—purely for validation. It protects against errors or fraud without impacting your balance, and it’s especially common with government payments.

- Triggers for IRS refunds, stimulus, or benefits.

- Typically updates in 1-3 business days.

- Holidays or weekends may add a day due to batch processing.

Seeing this isn’t a denial; it’s a sign your funds are on the way. Pair it with IRS status checks for peace of mind.

IRS Refund Processing Timeline for 2026 Filers

Once your e-filed return is accepted, the IRS targets issuing direct deposit refunds within 21 days. Complex returns with audits or mismatches can push this out, but most straightforward ones arrive promptly.

Paper checks take far longer—often 4-6 weeks—making electronic deposits the go-to for speed in 2026. After IRS approval, funds enter the ACH system, where banks review sender info, amounts, and account matches.

- Track progress with the IRS2Go app or “Where’s My Refund?” tool for overnight updates.

- “Pending” means en route, not rejected.

- Direct deposits beat checks for reliability and speed.

Banks vary in handling: some post immediately upon ACH alert, others wait for full settlement. Knowing your bank’s policies helps set expectations.

Common Delays and How to Spot Them

Issues like SSN errors or unreported income trigger IRS holds, sending you a letter to resolve. Tax refund 2026 delays from these are fixable but require quick action.

Bank-side, high-volume seasons amplify placeholders. Patience is key as most resolve automatically.

Why $2,000 Refunds Frequently Show $0 First

Refunds around $2,000 often combine withholdings with refundable tax credits like the Earned Income Tax Credit (EITC), Additional Child Tax Credit (ACTC), or American Opportunity Tax Credit (AOTC). These invite extra scrutiny to prevent fraud.

EITC and ACTC payments might hold until mid-February for verification, making the $0 phase more noticeable. Banks flag unusual amounts against your history, running automated checks that temporarily show zero.

Interest on overpayments adds complexity, sometimes treated separately. This multi-layer review explains why mid-range refunds like $2,000 take a beat longer than simple ones, but they always post fully once cleared.

IRS Issuance vs. Bank Posting: What You Need to Know

The IRS marks your refund as “issued” once sent, but your bank controls when it appears in your available balance. Federal rules allow next-day access for government deposits, yet internal verifications create the $0 tease.

Bank practices differ widely—one might credit $2,000 instantly, another holds for days. Check your account agreement or app for funds availability policies.

Early direct deposit options at banks like Chase or Wells Fargo can shave 1-2 days, perfect for 2026 filers eager for funds. Monitor both IRS and bank portals separately for the full picture.

Red Flags vs. Normal Delays

A $0 sticking beyond five business days? Contact your bank first. No negative balances or error codes mean all is well—it’s just processing.

Social media panic about “lost refunds” is hype; official IRS.gov trumps rumors every time.

Step-by-Step Guide to Handling Your 2026 IRS Refund

Start with proactive monitoring: bookmark “Where’s My Refund?” and enable bank alerts. Understand your bank’s ACH timelines to avoid surprises.

If the $0 lingers, call your bank—they excel at pending transaction details. Only escalate to IRS after confirming issuance without deposit.

- Have SSN, filing status, and exact amount ready for inquiries.

- Request a trace for truly missing funds (takes weeks).

- Keep records of all communications for faster resolutions.

Tax season lines are long, so early mornings beat crowds. For thorny issues, a tax professional can navigate complexities efficiently.

Essential Tips and Key Takeaways for Stress-Free Refunds

Mastering these insights transforms refund anxiety into anticipation. Here’s what to remember for smooth sailing in 2026:

- $0 placeholders mean funds are coming, not failing.

- Banks set the final posting speed after IRS release.

- $2,000 refunds get extra checks for credits—normal and secure.

- Most cases self-resolve; intervention is rare.

- Stick to irs.gov and your bank app over forums.

In conclusion, the shift from $0 to $2,000 is a hallmark of reliable IRS deposit 2026 operations. By decoding the IRS-bank dance, you sidestep pitfalls like unnecessary filings. Stay vigilant with daily checks, embrace the verification process, and watch your tax refund 2026 land right on time. Your hard-earned money is secure—patient tracking turns waits into wins.